Investor Charter

VISION

We will follow highest standards of ethics and compliances while facilitating the trading by Clients in Securities in a fair and transparent manner, so as to contribute in creation of wealth for Investors.

MISSION

- Provide high quality and dependable service through innovation, capacity enhancement and use of technology.

- Establish and maintain a relationship of Trust and Ethics with the Investors.

- Observe highest standard of Compliances and Transparency.

- Always keep ‘Protection of Investors’ interest’ as goal while providing service.

- Ensure confidentiality of information shared by Investors unless such information is required to be provided in furtherance of discharging legal obligations or Investors have provided specific consent to share such information.

Services provided to Investors

- Execution of Trades on behalf of Investors.

- Issuance of Contract Notes.

- Issuance of intimations regarding Margin due payments.

- Facilitate execution of early Pay-in obligation instructions.

- Periodic Settlement of Client’s Funds.

- Issuance of Retention Statement of Funds at the time of Settlement.

- Risk Management Systems to mitigate Operational and Market risk.

- Facilitate Clients profile changes in the system as instructed by the Client.

- Information sharing with the Clients w.r.t. relevant Market Infrastructure Institutions (MII) circulars.

- Provide a copy of Rights & Obligations document to the client.

- Communicating Most Important terms and Conditions (MITC) to the client.

- Redressal of Investor’s grievances.

Rights of Investors

- Ask for and receive information from us about the work history and background of the person handling your account, as well as information about the firm itself (including website providing mandatory information).

- Receive complete information about the risks, obligations, and costs of any Investment before investing.

- Receive a copy of all completed Account Opening Forms and Rights & Obligation document.

- Receive a copy of ‘Most Important Terms & Conditions’ (MITC).

- Receive Account Statements that are accurate and understandable.

- Understand the terms and conditions of transactions you undertake.

- Access your Funds in a prescribed manner and receive information about any restrictions or limitations on access.

- Receive complete information about maintenance or service charges, transaction or redemption fees, and penalties in form of tariff sheet.

- Discuss your Grievances with Compliance Officer / compliance team / dedicated Grievance Redressal team and receive prompt attention to and fair consideration of your concerns.

- Close your zero balance accounts with minimal documentation

- Get the copies of all policies (including Most Important Terms and Conditions) of the broker related to dealings of your account

- Not be discriminated against in terms of services offered to equivalent Clients

- Get only those advertisement materials from the us which adhere to Code of Advertisement norms in place

- In case of defaults, be compensated from the Exchange Investor Protection Fund as per the norms in place

- Trade in Derivatives after submission of relevant financial documents subject to our adequate due diligence.

- Get warnings on the trading systems while placing orders in securities where surveillance measures are in place

- Get access to products and services in a suitable manner even if differently-abled.

- Get access to educational materials of the MIIs and brokers.

- Get access to all the Exchanges of a particular segment you wish to deal with unless opted out specifically as per Broker norms

- Deal with one or more Stockbrokers of your choice without any compulsion of minimum business

- Have access to the escalation Matrix for communication with us.

- Not be bound by any clauses which are contravening the Regulatory provisions.

Rights of Investors

- Ask for and receive information from a firm about the work history and background of the person handling your account, as well as information about the firm itself.

- Receive complete information about the risks, obligations, and costs of any investment before investing.

- Receive recommendations consistent with your financial needs and investment objectives.

- Receive a copy of all completed account forms and agreements.

- Receive account statements that are accurate and understandable.

- Understand the terms and conditions of transactions you undertake.

- Access your funds in a timely manner and receive information about any restrictions or limitations on access.

- Receive complete information about maintenance or service charges, transaction or redemption fees, and penalties.

- Discuss your grievances with compliance officer of the firm and receive prompt attention to and fair consideration of your concerns.

Timelines for various activities

| Sr No. | Activities | Expected Timelines |

| 1 | KYC entered into KRA System and CKYCR | 3 working days of account opening |

| 2 | Clients On boarding | Immediate, but not later than one week |

| 3 | Order execution | Immediate on receipt of order, but not later than the same day |

| 4 | Allocation of Unique Clients Code | Before trading |

| 5 | Copy of duly completed Clients Registration Documents to Clients | 7 days from the date of upload ofUnique Clients Code to the Exchange by the Trading Member |

| 6 | Issuance of Contract Notes | 24 hours of execution of Trades |

| 7 | Collection of upfront Margin from Client | Before initiation of trade |

| 8 | Issuance of intimations regarding other Margin due payments | At the end of the T day |

| 9 | Settlement of Clients Funds | First Friday/Saturday of the month / quarter as per Exchange pre- announced schedule |

| 10 | ‘Statement of Accounts’ for Funds, Securities and Commodities | Weekly basis |

| 11 | Issuance of retention statement of Funds/commodities | 5 days from the date of settlement |

| 12 | Issuance of Annual Global Statement | 30 days from the end of the financial year |

| 13 | Investor grievances redressal | 21 calendar days from the receipt of the complaint |

DOs and DON’Ts for Investors

| Sr No. | DOs | DON'Ts |

| 1 | Read all documents and conditions being agreed before signing the account opening form. | Do not deal with unregistered Stock Broker. |

| 2 | Receive a copy of KYC, copy of Account Opening documents and Unique Clients Code. | Do not forget to strike off blanks in your Account Opening and KYC. |

| 3 | Read the product / operational framework / timelines related to various Trading and Clearing & Settlement processes. | Do not submit an incomplete Account Opening and KYC form. |

| 4 | Receive all information about brokerage, fees and other charges levied. | Do not forget to inform any change in information linked to Trading Account and obtain confirmation of updation in the system. |

| 5 | Register your mobile number and email ID in your trading, demat and bank accounts to get regular alerts on your transactions. | Do not transfer Funds, for the purposes of trading to anyone other than a stock broker. No payment should be made in name of employee of stock broker. |

| 6 | If executed, receive a copy of Demat Debit and Pledge Instruction (DDPI) However, DDPI is not a mandatory requirement as per SEBI / Stock Exchanges. Before granting DDPI, carefully examine the scope and implications of powers being granted. | Do not ignore any emails / SMSs received with regards to Trades done, from the Stock Exchange and raise a concern, if discrepancy is observed. |

| 7 | Receive Contract Notes for Trades executed, showing Transaction Price, brokerage, GST and STT/CTT etc. as applicable, separately, within 24 hours of execution of Trades. | Do not opt for digital contracts, if not familiar with computers. |

| 8 | Receive Funds and securities/ commodities on time, as prescribed by SEBI or exchange from time to time. | Do not share trading password. |

| 9 | Verify details of Trades, Contract Notes and Statement of Account and approach relevant authority for any discrepancies. Verify trade details on the Exchange websites from the trade verification facility provided by the Exchanges. | Do not fall prey to fixed / guaranteed returns schemes. |

| 10 | Receive statement of accounts periodically. If opted for running account settlement, account has to be settled by the stock broker as per the option given by the Clients (Monthly or Quarterly). | Do not fall prey to fraudsters sending emails and SMSs luring to trade in stocks / securities promising huge profits. |

| 11 | In case of any grievances, approach stock broker or Stock Exchange or SEBI for getting the same resolved within prescribed timelines. | Do not follow herd mentality for investments. Seek expert and professional advice for your investments. |

| 12 | Retain documents for trading activity as it helps in resolving disputes, if they arise. |

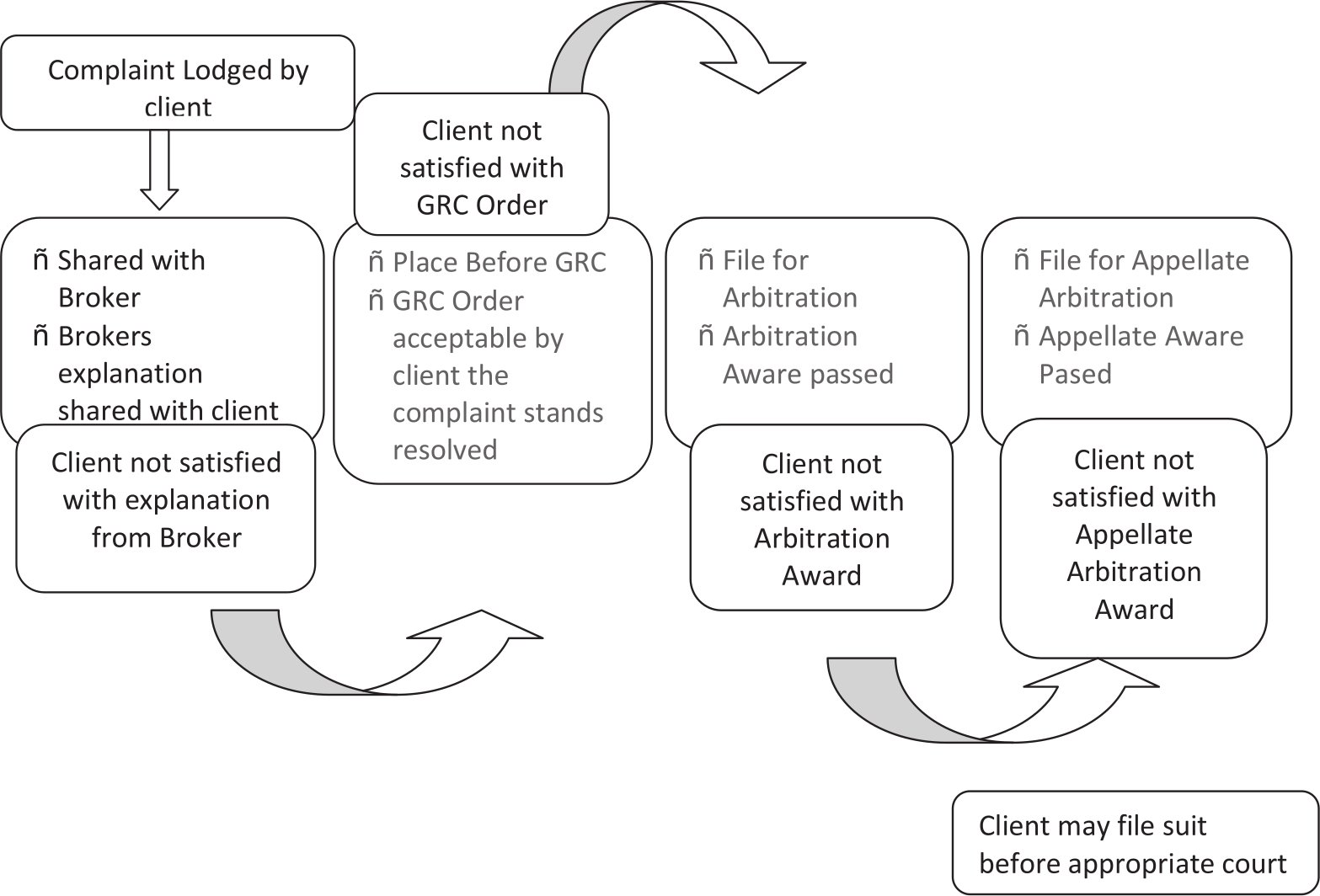

Grievance Redressal Mechanism

In absence of response/complaint not addressed to your satisfaction, you may lodge a complaint with SEBI at https://scores.gov.in/scores/Welcome.html or Exchange at https://investorhelpline.nseindia.com/NICEPLUS/. Please quote your Service Ticket/Complaint Ref No. while raising your complaint at SEBI SCORES/Exchange portal.

Timelines for complaint resolution process at Stock Exchanges against stock brokers

| Sr.No. | Type of Activity | Timelines for Activity |

| 1 | Receipt of Complaint | Day of complaint (C Day). |

| 2 | Additional information sought from the investor, if any, and provisionally forwarded to stock broker. | C + 7 Working days. |

| 3 | Registration of the complaint and forwarding to the stock broker. | C+8 Working Days i.e. T day. |

| 4 | Amicable Resolution. | T+15 Working Days. |

| 5 | Refer to Grievance Redressal Committee (GRC), in case of no amicable resolution. | T+16 Working Days. |

| 6 | Complete resolution process post GRC. | T + 30 Working Days. |

| 7 | In case where the GRC Member requires additional information, GRC order shall be completed within. | T + 45 Working Days. |

| 8 | Implementation of GRC Order. | On receipt of GRC Order, if the order is in favour of the investor, debit the funds of the stock broker. Order for debit is issued immediately or as per the directions given in GRC order. |

| 9 | In case the stock broker is aggrieved by the GRC order, will provide intention to avail arbitration | Within 7 days from receipt of order. |

| 10 | If intention from stock broker is received and the GRC order amount is upto Rs.20 lakhs | Investor is eligible for interim relief from Investor Protection Fund (IPF).The interim relief will be 50% of the GRC order amount or Rs.2 lakhs whichever is less. The same shall be provided after obtaining an Undertaking from the investor. |

| 11 | Stock Broker shall file for arbitration | Within 6 months from the date of GRC recommendation |

| 12 | In case the stock broker does not file for arbitration within 6 months | The GRC order amount shall be released to the investor after adjusting the amount released as interim relief, if any. |

- Circular is issued to inform about declaration of Stock Broker as Defaulter.

- Information of defaulter stock broker is disseminated on Stock Exchange website.

- Public Notice is issued informing declaration of a stock broker as defaulter and inviting claims within specified period.

- Intimation to clients of defaulter stock brokers via emails and SMS for facilitating lodging of claims within the specified period.

Following information is available on Stock Exchange website for information of investors:

- Norms for eligibility of claims for compensation from IPF.

- Claim form for lodging claim against defaulter stock broker.

- FAQ on processing of investors’ claims against Defaulter stock broker.

- Provision to check online status of client’s claim.

Handling of Investor’s claims / complaints in case of default of a Trading Member / Clearing Member (TM/CM)

Default of TM/CM

Following steps are carried out by Stock Exchange for benefit of investor, in case stock broker defaults:

- Circular is issued to inform about declaration of Stock Broker as Defaulter.

- Information of defaulter stock broker is disseminated on Stock Exchange website.

- Public Notice is issued informing declaration of a stock broker as defaulter and inviting claims within specified period.

- Intimation to clients of defaulter stock brokers via emails and SMS for facilitating lodging of claims within the specified period.

Following information is available on Stock Exchange website for information of Investors:

- Norms for eligibility of claims for compensation from IPF.

- Claim form for lodging claim against defaulter stock broker.

- FAQ on processing of Investors’ claims against Defaulter stock broker.

- Provision to check online status of client’s claim.

- Standard Operating Procedure (SOP) for handling of Claims of Investors in the Cases of Default by Brokers

- Claim processing policy against Defaulter/Expelled members

- List of Defaulter/Expelled members and public notice issued

Data for month ending April, 2025

| Sr No. | Received from | Carried forward from previous month | Received during the month | Total Pending | Resolved* | Pending at the end of the month** | Average Resolution time^ (in days) | |

| Pending for less than 3 months | Pending for more than 3 months | |||||||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | |

| 1 | Directly from Investors | Nil | 1 | Nil | 1 | Nil | 1 Day | |

| 2 | SEBI (SCORES 2.0) | Nil | Nil | Nil | Nil | Nil | Nil | |

| 3 | Stock Exchanges | Nil | Nil | Nil | Nil | Nil | Nil | |

| 4 | OtherSources (if any) | Nil | Nil | Nil | Nil | Nil | Nil | |

| 5 | Grand Total | Nil | 1 | Nil | 1 | Nil | Nil | |

Trend of monthly disposal of complaints

| Sr No. | Month | Carried forward from previous month | Received | Resolved* | Pending** |

|---|---|---|---|---|---|

| 1 | 2 | 3 | 4 | 5 | 6 |

| 1 | April -2024 | Nil | Nil | Nil | Nil |

| 2 | May- 2024 | Nil | Nil | Nil | Nil |

| 3 | June-2024 | Nil | Nil | Nil | Nil |

| 4 | July-2024 | Nil | Nil | Nil | Nil |

| 5 | Aug -2024 | Nil | Nil | Nil | Nil |

| 6 | Sept-2024 | Nil | Nil | Nil | Nil |

| 7 | Oct- 2024 | Nil | Nil | Nil | Nil |

| 8 | Nov - 2024 | Nil | Nil | Nil | Nil |

| 9 | Dec - 2024 | Nil | Nil | Nil | Nil |

| 10 | Jan -2025 | Nil | Nil | Nil | Nil |

| 11 | Feb - 2025 | Nil | 1 | 1 | Nil |

| 12 | March-2025 | Nil | Nil | Nil | Nil |

| 13 | April - 2025 | Nil | Nil | Nil | Nil |

Trend of annual disposal of complaints

| Sr No. | Year | Year Carried forward from previous year | Received during the year | Resolved during the year | Pending at the end of the year |

|---|---|---|---|---|---|

| 1 | 2021-22 | Nil | Nil | Nil | Nil |

| 2 | 2022-23 | Nil | Nil | Nil | Nil |

| 3 | 2023-24 | Nil | Nil | Nil | Nil |

| 4 | 2024-25 | Nil | 1 | 1 | Nil |

| Grand Total | Nil | 1 | 1 | Nil |